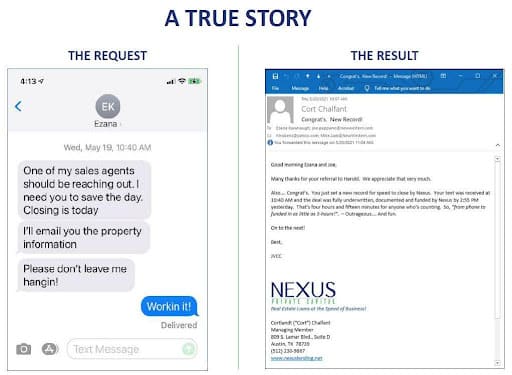

Nearly all hard money lenders advertise fast funding. But fast means different things to different people. At Nexus Private Capital, a direct lender located in Austin, Texas, fast means hours.

For most balance sheet lenders, like Nexus, fast probably means days or a week. And for hard money lenders that don’t use their own money (most lenders), fast almost certainly means two weeks or more.

So how can Nexus close so quickly when others can’t? The answer is simple in concept but complex in execution.

- Let’s take the simple part first. To close a deal in hours conceptually you need:

- A lender, borrower and title company on their game with the right attitude.

- Decision makers – not intermediaries – fully engaged up-front.

- A lender that uses their own funds – meaning, they don’t sell their loans or “table fund” with an invisible capital provider.

At Nexus, we check all of the boxes that are in our control and we’re super-efficient, which means we can turn even skeptical escrow agents into fans.

Notwithstanding what’s simple in concept, these are “full-doc loans” subject to a complex list of due diligence, documentation and coordination before funding can happen. Here’s what’s required.

- A title company that has a clean title report already prepared and won’t roll it’s eyes when told it’s a same-day closing.

- A borrower that’s organized with their personal information ready to go.

- A lender with a can-do attitude, who is willing to set aside other pressing priorities to go to bat for a stressed-out borrower.

- The lender needs to analyze and value the collateral property, submit a term sheet to the borrower and reach agreement on terms quickly.

- Next, the lender immediately introduces itself to the escrow agent and clearly communicates instructions and a request for title documents, tax certificate, wiring instructions and more.

- At the same time, the lender requests loan documents from its attorney and completes a three-way introduction to the escrow agent.

- Likewise, the lender requests a sizeable data dump from the borrower including entity documents, a formal loan application, bank statements and tax returns, a short bio, construction budget, coordinates a tour of the property plus a personal interview, if it’s a new client. In our case, a survey may or may not be requested and we don’t need to wait for an appraisal. Independently, we will run a credit report and conduct background checks on the client and his partners if he/she has any.

- Assuming the scrubbing checks-out, Nexus issues a Commitment Letter, reviews loan and escrow documents upon receipt and wires funds for the closing to the escrow agent for safekeeping until release is authorized.

- Meanwhile the borrower needs to tee-up property insurance and circulate evidence of insurance with the correct clauses and coverages – often a task that takes more than one attempt.

- Finally, the borrower heads to the title company, signs 130-pages of fine print which then gets sent to the lender for a completion check. After all that, the lender authorizes funding.

If you’re out of breath from reading this, then we proved our point. What Nexus does is simple in concept but outstanding in execution!